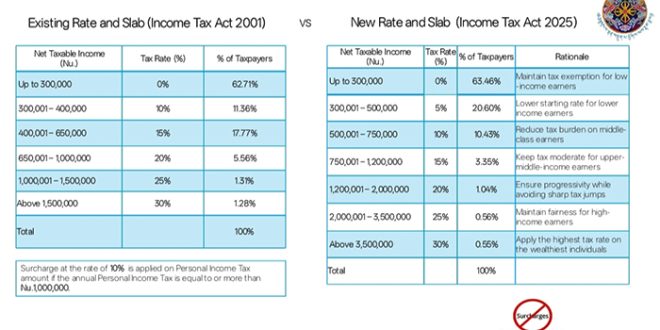

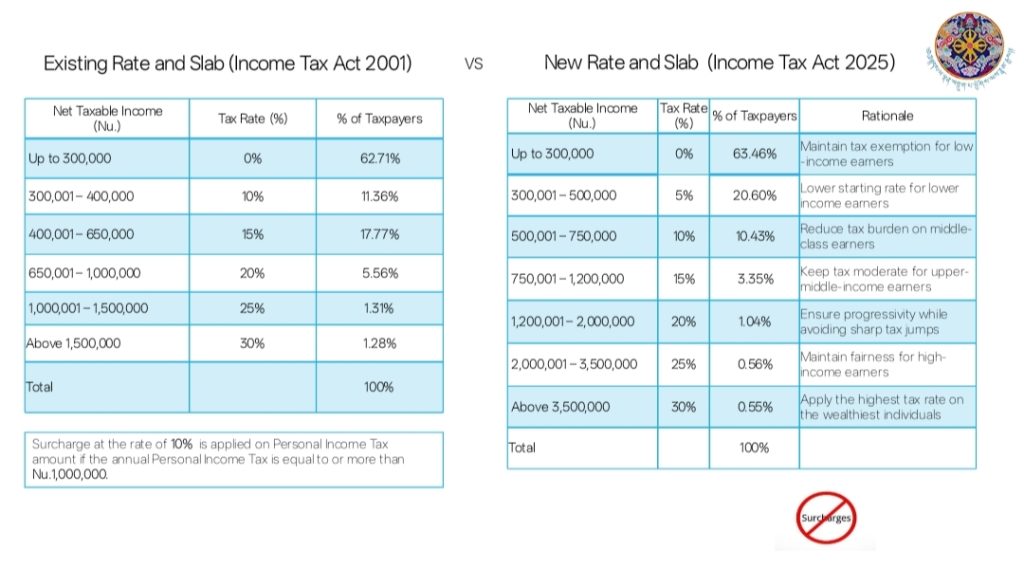

Bhutan’s new Income Tax Act 2025 effective from 1st January 2026 brings major changes to make the tax system simpler, fairer, and easier for everyone. The Department of Revenue and Customs (DRC) says the reforms are designed to modernize Bhutan’s taxation and align it with international standards.

Under the new law, all individuals and businesses with taxable income must file their tax returns by 30th April each year. Surcharge taxes have been removed.

For individuals, Provident Fund and Group Insurance deductions are replaced with a standard deduction of 15% of total employment income, or Nu 150,000, whichever is lower. Progressive income tax rates remain, but many reliefs and credits have been increased. Education expenses per child can now be deducted up to Nu 50,000 (total up to Nu. 350,000 with receipts). Home loan interest can be claimed up to Nu 200,000, insurance relief up to Nu 50,000, and disability relief stays at Nu 40,000. A new Parenthood Child Tax Credit gives Nu 1,000 for the first child up to Nu 10,000 for the fourth and more children.

Dividends up to Nu 300,000 and fixed deposit interest up to Nu 400,000 are exempt, anything above is taxed at 10%. There will be no capital gains tax for individuals selling personal assets outside business use.

A big change is merging Business Income Tax (BIT) with Personal Income Tax (PIT). The Finance Secretary, Leki Wangmo, explained that this makes the system fairer and simpler, especially for small business owners. Corporate Income Tax (CIT) is now 22% for all companies, down from 25–30%. Small businesses with turnover under Nu 5 million can use a simpler presumptive tax system, though professionals like doctors and lawyers are excluded.

The law now covers unlicensed vendors and informal businesses, requiring all income to be reported. Businesses also benefit from relaxed rules on expenses, indefinite loss carry-forward, and updated debt rules based on EBITDA instead of fixed ratios.

Penalties for late filing remain, but the interest rate for delayed payments is reduced from 24% to 15% per year. The Director General of DRC, Sonam Jamtsho, said the reforms aim to make taxation “simpler, more transparent, and supportive of economic growth,” encouraging voluntary compliance while protecting national revenue.

The Income Tax Act 2025 sets Bhutan on a path toward a fair, efficient, digital, and transparent tax system that benefits both citizens and the economy.

The Bhutanese Leading the way.

The Bhutanese Leading the way.