With the implementation of the Goods and Services Tax (GST) scheduled for January 2026, concerns have been raised by hardware association, automobile dealers, and other businesses with large inventories over potential financial disruptions. Finance Minister, Lekey Dorji, has stated the government’s position and measures to address these issues.

On the request from the hardware sssociation, Lyonpo Lekey Dorji said the ministry acknowledged receipt of a formal appeal submitted to the Department of Revenue and Customs (DRC) on 26th August 2025.

The association sought transitional tax credits to offset the impact of GST on large inventories. However, Lyonpo Lekey Doster noted that the DRC had already issued a clarification on 19th August 2025, stating that such transitional adjustments are not permissible under the GST framework. While the ministry is unable to commit to the requested relief, it has sought further information from the association to better understand the scope and implications of the appeal.

As of 22nd September 2025, details such as a verified membership list of the association and the average monthly sales tax contributions by its members remain pending. Lyonpo reiterated earlier advisories to all prospective GST registrants to prudently manage inventory levels during the transition period to mitigate potential financial disruptions, and ensure a smooth shift to the new tax regime.

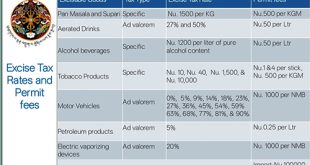

On concerns from automobile dealers, Lyonpo Lekey Dorji said the government has extended bonded warehouse facilities to all vehicle dealers under the provisions of the Customs Act. This arrangement allows vehicles imported after the enactment of the GST (Amendment) Act 2025 and the Excise Tax Act 2025 in July 2025 to be stored in bonded warehouses without incurring immediate tax liabilities.

GST and Excise Tax will only be levied when the vehicles are cleared for domestic sale or consumption. Importantly, this provision also applies to vehicles imported prior to January 2026 but held in bonded warehouses. Such vehicles will attract GST and Excise Tax at the point of release. He explained that this measure is intended to support a smooth transition for automobile dealers, facilitate better cash-flow management, and ensure the effective rollout of the new tax regime.

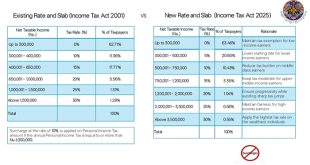

Lyonpo Lekey Dorji stated that GST may create a mild inflationary pressure of around 1 to 2 percent during the transition period, but its inherent self-regulating nature will soon stabilize prices. Comprehensive measures have already been taken, including overhauling the Income Tax framework and amending the GST Act. He said that the country will implement one of the best-designed GST systems globally.

He said that the government has conducted in-house research and engaged international experts. These studies consistently recommended amendments to minimize GST exemptions and to separate and rationalize Excise from GST in order to reduce inflationary impacts. With the successful enactment of these amendments, the inflationary effects from GST implementation are expected to be minimal.

The Bhutanese Leading the way.

The Bhutanese Leading the way.