Aum Deki from Changangkha in Thimphu, on the morning of 1st January, went to her usual shop to buy her packet of Doma priced at Nu 50. She gave Nu 50, but the shopkeeper shook her head and asked for an additional Nu 3 as ‘GST Tax.’

In the evening, Aum Deki went to buy another item in the shop, and again, the shopkeeper charged the ‘GST Tax’ on her usual grocery purchases. Not aware of GST and no longer able to hold back, Aum Deki gave the shopkeeper her piece of mind and pledged to never buy anything from the shop.

Shifting the scene to Paro town, in the midst of a group of shoppers faced with GST Tax at a major shop there, a local resident had whipped out his phone showing a video and busy blaming the current government for the GST Tax. The Parop who was in an irate mood loudly declared, “I will never vote for this government again.”

The introduction of the 5% Goods and Services Tax (GST) from 1st January 2026 has been welcomed with collective shock, a whole lot of confusion and also some anger due to the increased prices of essentials.

Department of Revenue and Customs (DRC) Commissioner Sherab Chogyel, said, “People are facing a sudden price increase mainly due to old stocks which had been charged Bhutan Sales Tax (BST) also being charged the GST. Once the old stocks are sold out and items are charged only GST, then price increases will either be more moderate and many items’ prices will also come down.”

The Bhutanese requested for data from the DRC, and conducted an analysis and found that there are items where prices will go up by 5%, while some item prices will come down marginally or even significantly.

The overwhelming majority of Bhutan’s imports are from India in all categories of goods from food to consumer items.

The GST Tax system excludes rice, cooking oil, salt, sanitary pad and wheelchair.

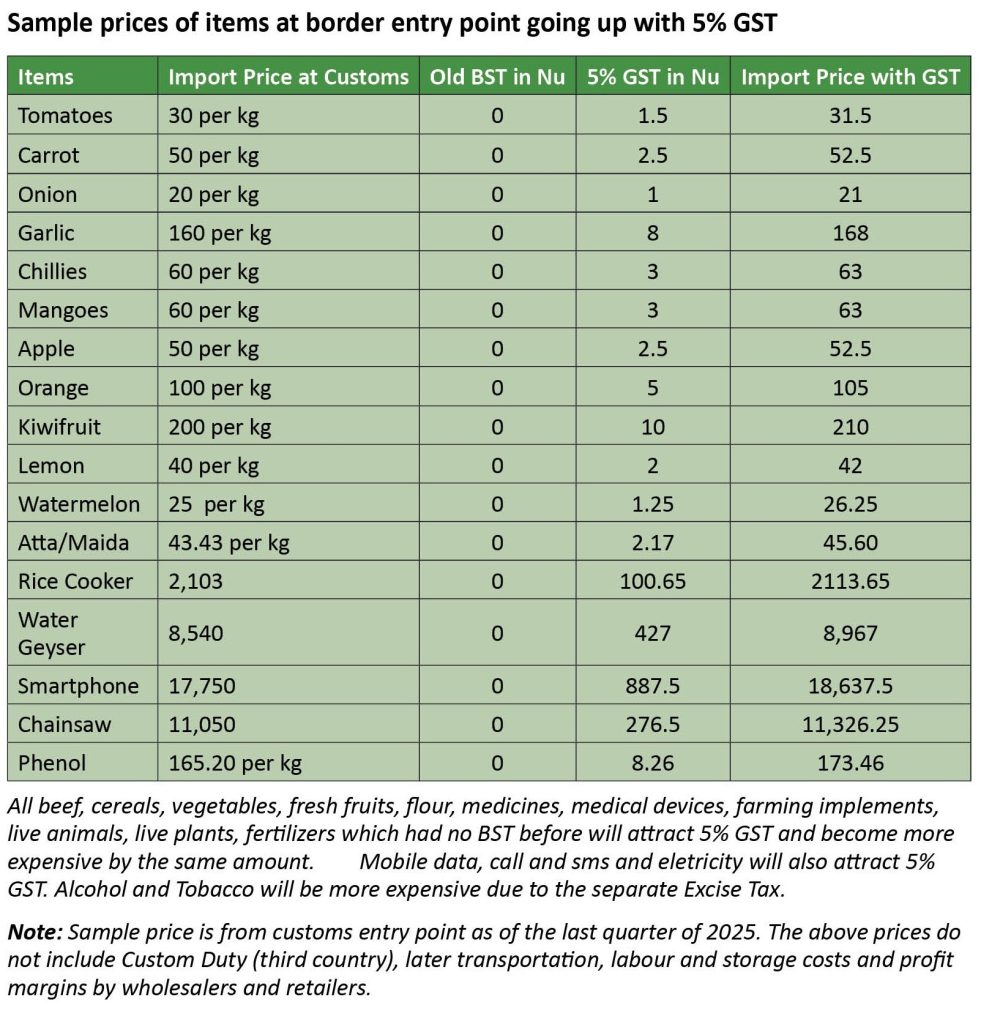

Regarding the price rise, there will be a 5% price increase in all items that previously had no BST, also called zero rated items. These are items like all cereals, vegetables, fruits, beef, and flour imported from India (see box).

Similarly, all medicines and medical devices which were zero rated before will also be charged 5% GST.

There are also other items which are zero rated under BST like books, rice cookers, geysers, smartphones, chainsaw, phenol, etc whose prices all go up by 5% due to GST.

Your electricity and phone bills, be it data, voice or SMS, will also go up by 5% under GST.

For farmers and the livestock sector too, there will be an impact, as farming implements, fertilizers, seeds, live plants, live animals, which were previously zero rated, will attract the 5% GST.

The price of some precious metals, like gold and silver, will also go up as their BST was lower at 2.5% and 4% respectively.

Alcohol and tobacco will be more expensive due to the separate Excise Tax.

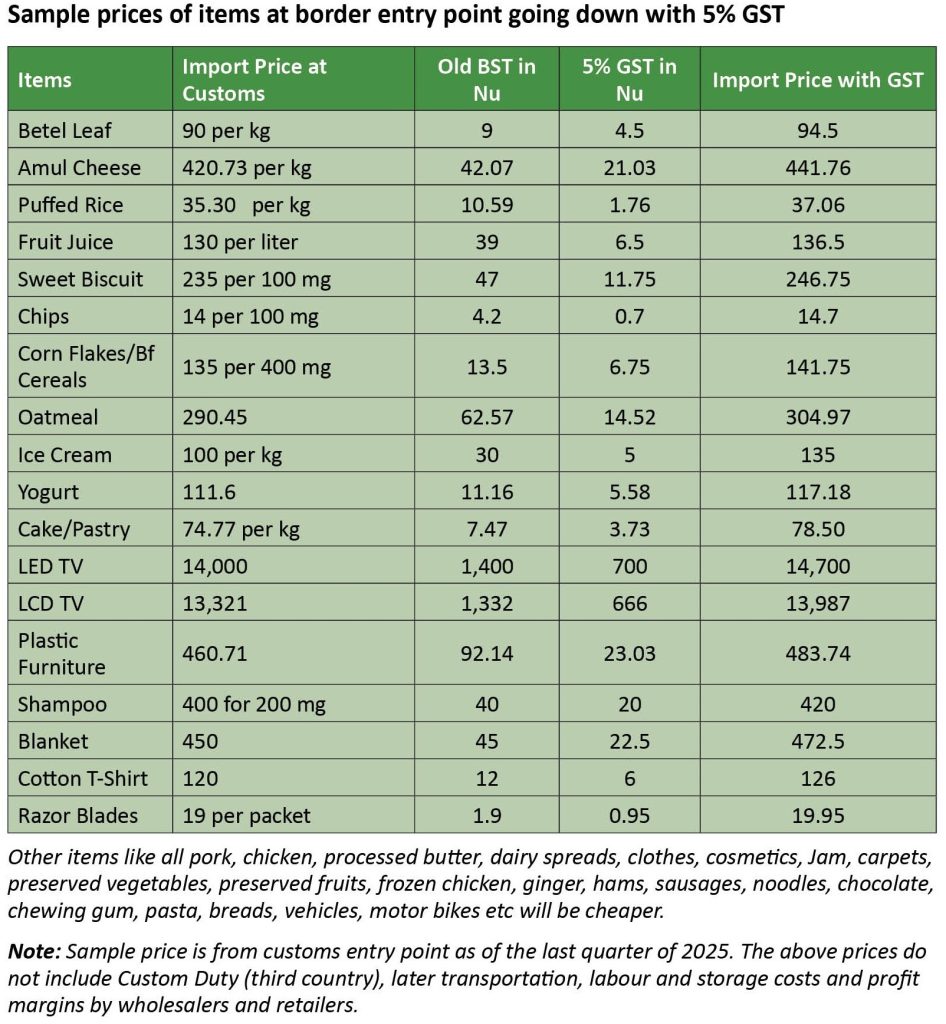

However, it is not just about price rise above, as there are quite a few items in which prices are coming down due to the GST replacing the higher BST rates of the past (see box).

These are items like pork and chicken which earlier had a 20% BST to protect local farmers and will now only have 5% GST.

It also includes electronic items like LED TV, LCD TV, preserved vegetables and fruits, processed cheese, butter, puffed rice, and all categories of packaged foods like all breakfast cereals, biscuits, noodles, chips, breads, sausages, ham, chocolates, oatmeal, cake or pastry, ice cream, fruit juices, chocolates, candy, chewing gum, etc.

There will be price drops in men’s and women’s clothes, cosmetics, shampoos, carpets, blankets, plastic furniture, betel leaves and more.

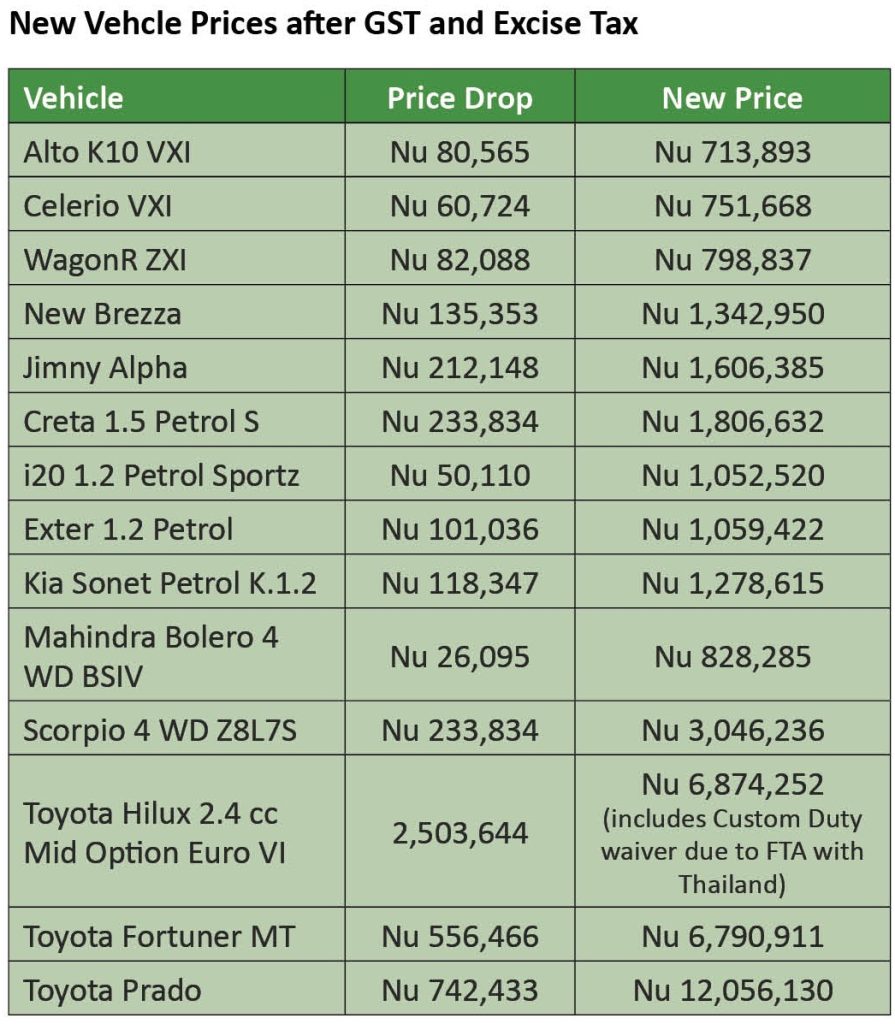

There will also be reductions in the prices of cars which is not only due to a lower GST of 5% but also due to the doing away with the Green Tax, which was inserted into the Excise Tax (see box).

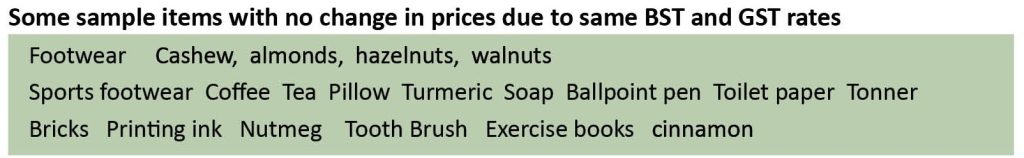

While prices go up and down, there are also certain products whose prices will remain the same, as their old BST and new GST rates are same. These products are footwear, cashew, almonds, hazelnuts, walnuts, sports footwear, coffee, tea, pillow, turmeric, soap, ballpoint pen, toilet paper, toner, bricks, printing ink, nutmeg, toothbrush, exercise books, cinnamon, etc.

There has been some confusion in certain products like cooking oil which is exempt. However, when one looks at the fine print in the GST Act only a narrow category is exempt, which is sunflower-seed, safflower or cotton seed oil, rape, colza or mustard oil. This does not include soyabean oil, rice bran oil, olive oil and other varieties.

On why even basic and essential items like vegetables, cereals, meats, fruits, medicines and farmers implements are not exempt from GST, the DRC had taken the call that if there are more exemptions then the tax implementation would be more difficult and complicated and it may even lead to leakages and give tax officials arbitrary powers which can also lead to misuse.

The GST is not just about collecting a consumption based tax but it will also help ensure more transparency in other tax declarations like Business Income Tax and Corporate Income Tax.

Commissioner Sherab said that under GST, there is always an incentive to declare the GST collected or paid, as GST registered businesses get Input Tax Credit where they can claim refund for the GST paid by them. This ensures that even if a business wants to hide its true income, it will think twice, as another business will be submitting the transaction to DRC.

The penalty provisions for tax avoidance have also been increased significantly.

Another issue is that shops who are not eligible to collect GST were doing so mainly out of ignorance and here DRC issued notifications saying they cannot do so and will be penalized.

Until now, a popular explanation in favor of GST is that it avoids double taxation with the theoretical idea being that BST is collected at both the import stage and consumption stage and in between.

However, this is not applicable to Bhutan, as BST was charged only at the point of entry for most goods, and at the point of sale only for vehicles, since Bhutan did not have such a system.

In the GST implementation, a major issue that has emerged is what to do with old stocks and this has mainly been raised by hardware shops and vehicle dealers. The main point of their argument is that their large stocks are subject to double taxation with both older and newer taxes being applicable.

Here, Commissioner Sherab said that the DRC will not do away with the older taxes, which have already been paid. He said if this is done then there are many others like grocery shops, etc., who also have old stock and are facing the same issues.

The Bhutanese Leading the way.

The Bhutanese Leading the way.