The government has strengthened its excise tax system to further promote public health, protect the environment, and encourage responsible spending among the people. The revised system focuses on certain goods such as alcohol, tobacco, supari, pan masala, vehicles, fuels, and aerated drinks, which are known to have negative impacts on health or the environment.

The Finance Secretary, Leki Wangmo, said that the revised excise tax aims to reduce the use of harmful and luxury products without affecting people’s daily needs. She said, “The goal is not to burden our citizens, but to safeguard public health and promote wiser choices that align with our values of wellbeing and sustainability.”

The Director General of the Department of Revenue and Customs (DRC), Sonam Jamtsho, explained that excise tax is different from other forms of taxation because it applies only to specific products. “This system focuses on goods that are either harmful or non-essential. It helps us promote responsible consumption while supporting economic balance and environmental protection,” he said.

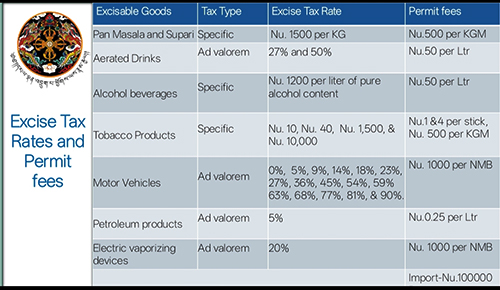

Under the updated framework, two types of excise taxes will apply. A specific tax sets a fixed rate per unit, for instance, per litre of alcohol or per stick of cigarette while an ad valorem tax is charged as a percentage of the product’s value, such as for vehicles and carbonated drinks. This ensures fairness by requiring those who buy expensive products to pay higher tax rates.

The main purpose of the excise tax is to discourage unhealthy consumption and luxury spending. It aims to protect people from diseases linked to tobacco, alcohol, and sugary drinks, while also reducing pollution from fuels and vehicles. At the same time, it encourages industries and consumers to choose more sustainable alternatives.

The tax will be paid by importers, manufacturers, and producers, but the cost will be reflected in the final selling price. As a result, items like alcohol, tobacco, and soft drinks may become slightly more expensive, while essential goods such as rice, oil, and vegetables will remain unaffected. The revenue collected from this tax will be used to fund public health programs, welfare projects, and awareness campaigns for the benefit of all citizens.

The excise tax will also apply to e-cigarettes and vaping products, which include nicotine liquids, cartridges, and electronic devices. This measure is in line with the World Health Organization’s advice to regulate all nicotine-containing products equally. Though e-cigarettes are sometimes seen as less harmful, the government stated that they still pose health risks and are especially dangerous for young users.

The revised system applies equally to both imported and locally produced goods, ensuring fairness and transparency. However, exports remain zero-rated, meaning no excise tax will be applied to products made for export, helping local producers remain competitive in foreign markets.

To keep the system effective, excise tax rates will be automatically adjusted every year based on inflation, ensuring that the value of the tax remains stable over time. DRC will be responsible for collecting and monitoring the tax, with digital systems in place to ensure transparency and prevent tax evasion.

Officials explained that the tax will have little effect on general inflation, as it only targets specific goods and not basic necessities. Businesses like bars, restaurants, and vehicle dealers may see small adjustments in sales, but are expected to adapt without major challenges. In fact, the system may encourage innovation, with more industries turning towards healthier and eco-friendly options.

International experience supports this move. Countries like Thailand, the Philippines, and Mexico have seen noticeable drops in alcohol, tobacco, and sugary drink consumption after strengthening their excise tax systems. Bhutan hopes to achieve similar success by improving public health, reducing healthcare costs, and encouraging responsible habits among its people.

The Bhutanese Leading the way.

The Bhutanese Leading the way.