A common online critique and allegation against the Economic Stimulus Plan (ESP) concessional credit loan these days is that it has primarily benefitted the rich and well-connected, and those with already big businesses compared to ordinary farmers and struggling people in need of the loan.

The Bhutanese decided to take a look at the overall ESP Concessional Credit loans and gain a better understanding on the data and process.

The Bhutan Development Bank Limited (BDBL) management said that any applicant, irrespective of their background, can apply for and is eligible for an ESP loan within the ESP criteria.

On the request of The Bhutanese, the BDBL shared overall data on the ESP loans and by sector.

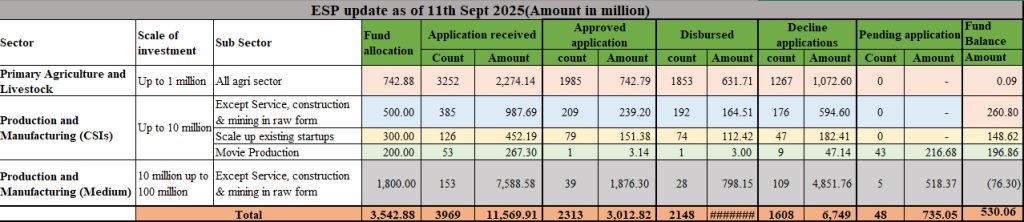

The ESP loan of Nu 3.5 billion (bn) concessional credit is for the three sectors of Primary Agriculture and Livestock up to Nu 1 million (mn), Production and Manufacturing of Cottage and Small Industries (CSI) up to Nu 10 mn and Production and Manufacturing of the Medium Sector which is Nu 10 mn to Nu 100 mn.

This automatically disqualifies the big industries and companies in the country who take loans in the hundreds of millions and even billions for their projects.

The BDBL said in the Primary Agriculture and Livestock sector the original allocation was Nu 500 mn, but given the demand, it was increased to Nu 742.88 mn.

There were 3,252 applicants applying for Nu 2.274 bn worth of loans.

The BDBL approved Nu 742.79 mn for 1,985 beneficiaries who are mainly farmers and people engaged in livestock benefiting from it. This would also include those who are trying agriculture based entrepreneurial activities in the villages. The average loan size here is between Nu 200,000 to Nu 400,000 mainly.

When asked how people were selected or rejected, the BDBL said most of those who were rejected were due to ongoing Non Performing Loans (NPLs) which automatically bars any applicant. There were then those who applied in non-agriculture and livestock areas like tourism, shop establishment, etc. Another reason for rejection was those who applied above the Nu 1 mn limit.

The bank said that even for those whose applications were accepted, many had tried to put the maximum amount of Nu 900,000 or Nu 1 mn, and here, the committees reduced the amounts based on their project proposals. The ability to service the loan was also looked at.

For the Production and Manufacturing (CSI) sector, CSI the allocation is Nu 1 bn but it is divided into three sub-categories.

First is Nu 500 mn for all activities minus service, construction and mining in raw form. In this category there were 385 applications worth Nu 987.69 mn. Ultimately there were 209 approved applications worth Nu 239.20 mn, leaving Nu 260.80 mn as fund balance.

Second is Nu 300 mn for scaling up existing startups, and for this there were 126 applications worth Nu 452.19 mn. Of this 79 applications worth Nu 151.38 mn were approved, leaving Nu 148.62 mn fund balance.

The rejections in the above two sub-categories were again primarily due to NPL loans. This is followed up by their proposals not being in line with ESP criteria. In some cases, the projects proposed were deemed not to be financially viable.

The BDBL said the ESP is not to fund ideas but businesses, and while some came with ideas, they lacked the business and financial plan and also the implementation plan on the ground.

The third sub category is Nu 200 mn for movie production where 53 applicants worth Nu 267.30 mn applied, and here, only one application worth Nu 3.14 mn was approved leaving Nu 196.86 mn fund balance.

The BDBL management said the bank and its committees involved a lot of movie experts and stakeholders in its assessment, and also looked at the international situation. The bank found that internationally banks gave loans to movie studios who would have hits and some flops, but would be able to pay back the loans. However, the applicants were all for single movies and the BDBL did not want to take the risk because some films would not do well and that would be automatic loss for the bank.

The sole loan was given by BoB.

It instead put the matter to the ESP steering committee saying it cannot give loans to movies given the risk. The BDBL said the Department of Media, Creative Industry and Intellectual Property (DoMCIIP) already had a Nu 530 mn Creative Industry ESP fund which was being given as grants to film makers among others.

In Production and Manufacturing (Medium) sector, there was an allocation of Nu 1.800 bn and here there were 153 applicants applying for Nu 7.588 bn and in the end there are 39 approved applications worth Nu 1.876 bn.

Here too, the ones who could not make it had NPL loans mainly. Others put proposals outside the ESP criteria and in the case of others there were doubts about the financial viability of the project.

In the original ESP concessional credit line, there was Nu 3.300 bn allocated in total but it was increased by Nu 242 mn on account of demand from agriculture and thus the total allocation became Nu 3.542 bn.

Of the Nu 3.542 bn, a total of Nu 3.012 bn has been approved for allocation leaving a balance of Nu 530.06 mn.

The BDBL said the ESP Steering Committee will have to decide what to do with this balance amount.

Against the available fund of Nu 3.542 bn, there were 3,969 applications worth Nu 11.569 bn of which 2,313 applications were approved at Nu 3.012 bn.

Of the Nu 3.012 bn approved amount, the amount disbursed as of 11th September 2025 is Nu 1.709 bn .

The BDBL management said that initially the ESP concessional credit loan was given to all the Financial Institutions (FIs) but there were soon issues of loans not being given.

This is because many of the applicants were in the agriculture and CSI sector which are seen by FIs as high risk.

With FIs not willing to loan out funds, the BDBL said they took it up as a social mandate.

BDBL said they hired 20 staff on contract just to work on ESP loans and also an ESP General Manager on contract. Apart from this, BDBL has put in 70 of its full time employees across all branches to receive ESP proposals and give information apart from their normal banking duties.

The BDBL management said that while ESP is only a small part of their overall operations, it has taken up 50 percent of the time of the BDBL management, which has to evaluate the loans, listen to loan pitches, do research and take decisions. The bank said the ones doing this were doing this in addition to their normal banking duties and there is no remuneration.

When it comes to loan evaluation there are different committees in BDBL.

If the proposal is above Nu 3 mn there is a review of the documents and the project, and they schedule the pitching of proposals. There is no pitching for loans under Nu 3 mn.

All the pitching committee members are to declare conflict of interest in writing. The committee could be declining the project or recommending for further review.

There is a detailed review of the proposal, and if it is positive then there is a preparation of the proposal to the approval committee.

The presentation is done to the main committee comprising of the CEO and four GMs. There is again a declaration of conflict of interest.

If the loan is approved, it is sent for post sanction documentation and then disbursement after which there is monitoring of the projects.

The Bhutanese Leading the way.

The Bhutanese Leading the way.